When you’re considering two watches, which one would an average buyer be more likely to buy:

A watch made by a ‘traditional’ company or household name with global recognition, and an average global user rating of 4 stars out of 5 or A watch made by a largely unknown watchmaker whose name you have never heard mentioned outside the four walls of your local Redbar gathering - but rated 5 stars out of 5 by every collector you meet (admittedly a much smaller sample)?

That’s a loaded question, because I suspect that the average reader of my posts would possibly lean towards the unknown watchmaker in the wake of the recent boom in the independent watchmaking scene. That said, if such a question was posed to a sample of representative watch buyers globally, they would lean towards the household name.

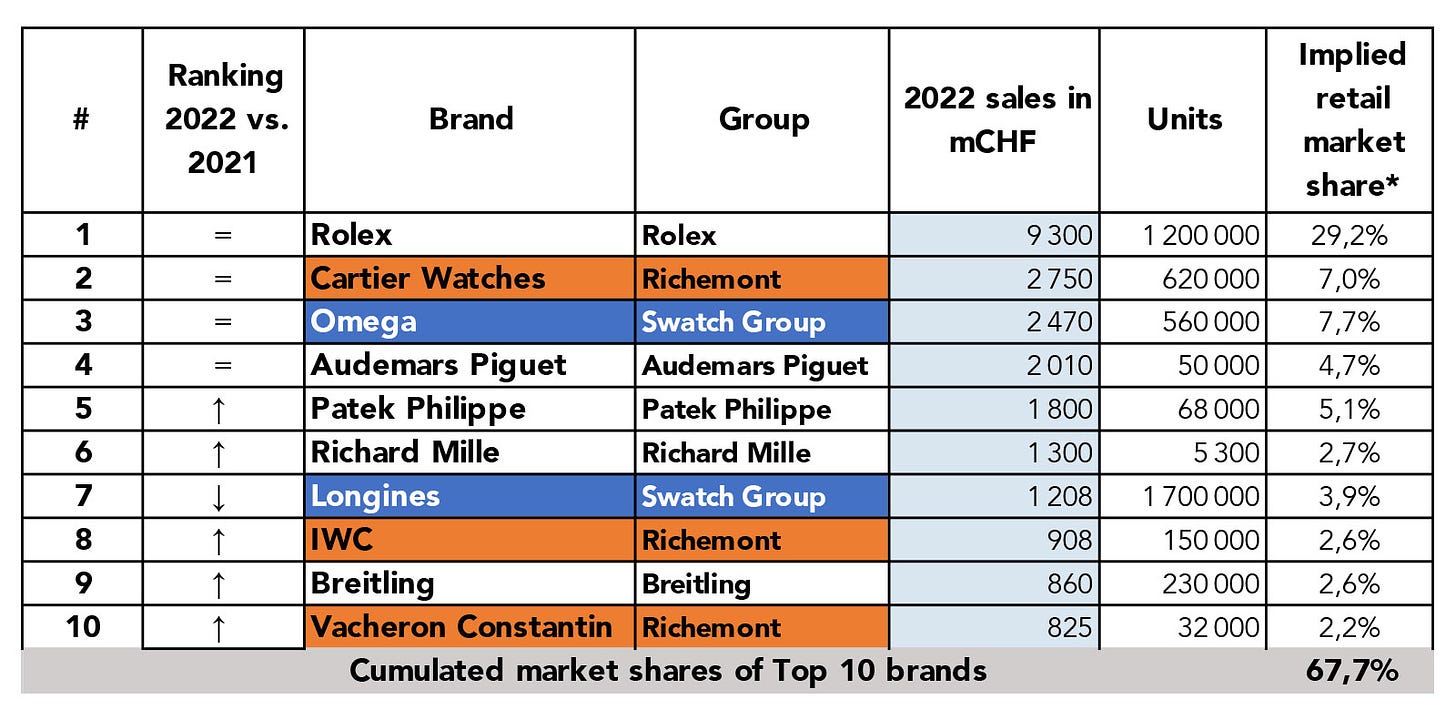

This is just the nature of the luxury industry after all. If something lacks the ability to signal, then is it even luxury at all? How else does Rolex maintain such a large percentage of their market share? I wrote two other posts about this:

Anyway, the ambiguity effect is a cognitive bias where decision making is affected by a lack of information, or… "ambiguity". In this case, most watch buyers would rather buy the above average ‘known' entity’ than take a chance on a hidden gem. The issue here, is that the lesser known watchmaker lacks a track record, and leads buyers to play it safe.

Many of the stories I hear from collectors about their decision making processes, seem to confuse two related but distinct concepts: